The following bank details apply to both domestic and international applicants.

Kindly contribute to Trust voluntarily for “Shri Khodiyar Mandir Trust" at Rajpara.

Trust Name: “Shri Khodiyar Mandir Trust" Rajpara.”

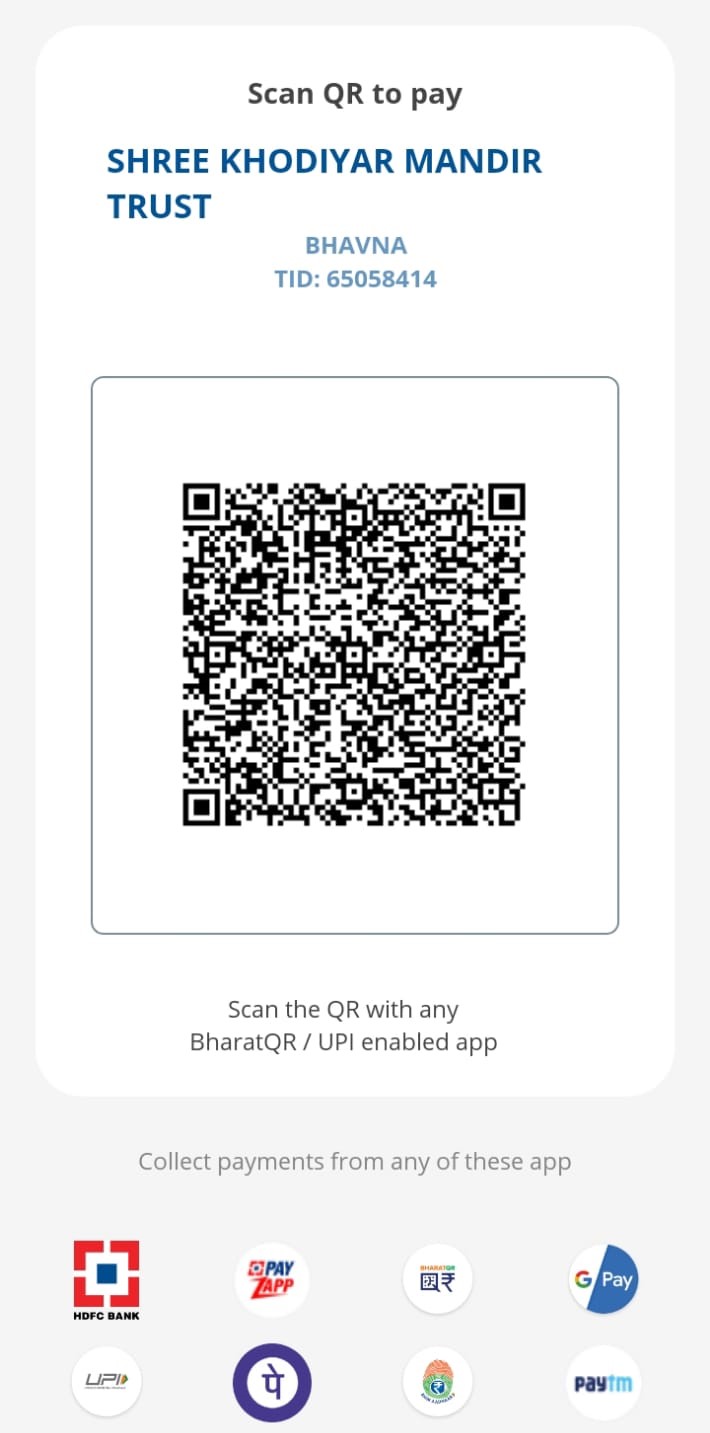

“Shri Khodiyar Mandir Trust" Rajpara” bank account details are:

Offerings can be made directly to the temple’s authorized bank account mentioned below.

| Bank Name | State Bank of India |

| Account Number | 56318018833 |

| MICR Code | 364002011 |

| IFSC | SBIN0060318 |

| Branch | Nilambaug Branch |

| Location | Bhavnagar, Gujarat |

Thank you for your support!

*The Central Government has notified "SHREE KHODIYAR MANDIR TRUST" to be a place of historic importance and a place of public worship of renown for the purposes of the said section from the year F.Y. 2020-2021, vide CBDT Notification.

*50% of Voluntary Contribution, for the purpose of renovation/repair of Mandir, to Shree Khodiyar Mandir Trust, Bhavnagar (Gujarat) is eligible for deduction under sec 80G(2)(b), subject to other conditions mentioned under section 80G of the Income Tax Act, 1961.

*Cash Donation in excess of Rs. 2000 is not eligible for deduction under section 80G.